Enterprise Version

Problem

The Indian stock market

has over 4,500 listed companies, making it

challenging for traders to identify potential stocks with

high probabilities.

Solution

ATA analyses pool of NSE and BSE stocks and brings out

stocks which have highest probability

to move upwards within next 14-28 Days on an

average.

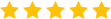

Track, Analyse.

No Emotional Bias.

Powered by data and analytics, our platform eliminates

emotional biases by providing fact-driven insights, empowering

investors to make informed and confident decisions.

Stock Technical Analysis

Maximize returns and minimize risks by drilling down into

the general strength of stocks and sectors at any selected

period over the year.

- Fundamental of stocks, insider trading, RSI, confidence points, Research firms recommendations, and more.

- The data gets churned frequently and aligns with changing market dynamics.

Sector Cycle Detection

Gives and overview on how sectors have been superseding week

over week, help to visualize trending sectors and invest

accordingly.

- Highly accurate sector cycle detection and prediction

- Sector-driven stock selectors

Stock News & Market Insights

Business Today

India sets a ₹9.15 lakh crore blueprint for power

sector to meet 458 GW demand by 2023.

-

The Hindu Business LineAnalysts recommend buying L&T Finance, HDFC Life, SAIL, JK Cement, Coal India and IDFC First Bank in today's trade.

The Hindu Business LineAnalysts recommend buying L&T Finance, HDFC Life, SAIL, JK Cement, Coal India and IDFC First Bank in today's trade. -

Hindustan TimesM&M stock hits new high as m-cap nears Rs 4 trillion; zooms 100% in 10 months.

Hindustan TimesM&M stock hits new high as m-cap nears Rs 4 trillion; zooms 100% in 10 months. -

CNBC TV18Paytm shares rise 3% after Emkay upgrade to 'Add'; doubles target price.

CNBC TV18Paytm shares rise 3% after Emkay upgrade to 'Add'; doubles target price.

FAQs

Our AI and machine learning models analyze large

datasets, including economic indicators, market

sentiment, and financial data, to forecast sector

movements and provide actionable insights, helping

traders make informed decisions.

Retail traders, fund managers, wealth managers, and

technical analysts can all benefit from our platform,

as it provides deep insights into market trends,

investment opportunities, and sector performance.

Yes, our platform provides real-time data insights and

predictive forecasts powered by AI and machine

learning, allowing users to make informed, timely

trading decisions.

While Abillion Trade Analytics provides real-time

insights and forecasts, it does not currently support

trade execution. You can use our insights to inform

your trades on your preferred brokerage platform.

Get Started

Why Abillion Trade Analytics?

It has delivered an impressive 66.67% Compound Annual Growth Rate (CAGR) over the past year.

It has delivered an impressive 66.67% Compound Annual Growth Rate (CAGR) over the past year.